If you find yourself in the market for a personal loan, it won’t be long before you realize that you have quite a few options.

When considering both local and national lenders, it’s easy to become overwhelmed by the selection.

Fortunately, with the help of the internet, you can quickly narrow your options as to make an informed and confident decision. And this is where Zippyloan typically comes into play.

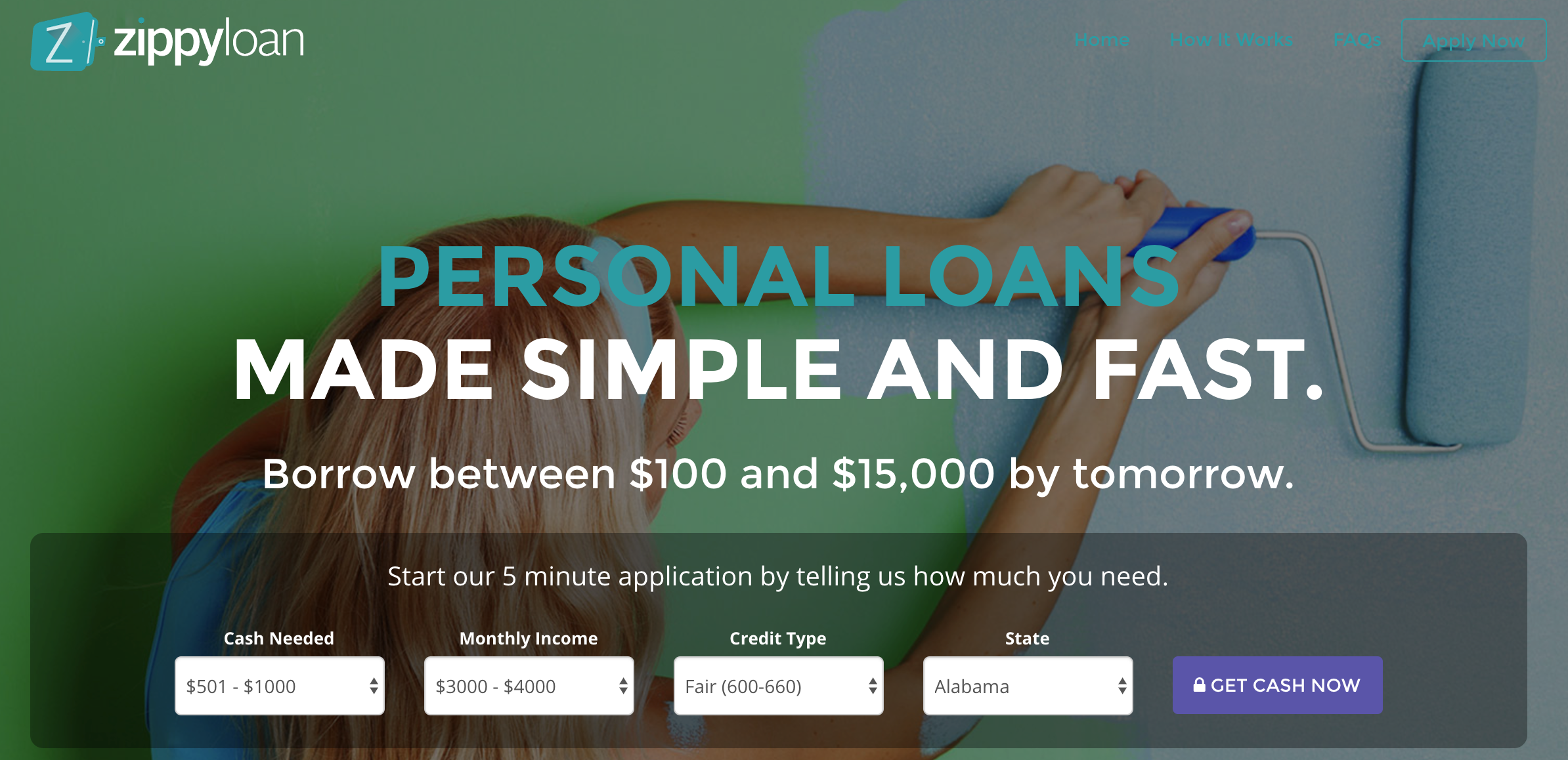

With Zippyloan, you can submit a personal loan application online. Not only can you complete the application within a matter of minutes, but you will also receive a decision in real-time.

How is Zippyloan Different?

Obtaining a personal loan is a big decision, as this will alter your finances in a number of ways. For this reason, you want to choose the right product from the right lender.

The primary benefit of working with Zippyloan is that you gain instant access to a large network of lenders.

Once you complete an application, it’s instantly sent to 100+ lenders for review. From there, a variety of lenders will offer multiple options to ensure that you find the loan that best suits your credit situation, financial needs, and goals.

Here are a few additional reasons for the growing popularity of Zippyloan:

- Ability to request a loan up to $15,000, with an instant decision

- Online application that takes five minutes (or less) to complete

- Application form optimized for both Android and iOS, allowing you to apply from your smartphone or tablet

What’s Next?

After you complete an application and receive multiple offers, you’ll want to review the details of each one.

From there, a few things must happen:

- Choose the loan amount that’s best for you

- E-sign your loan agreement

- Wait for your deposit to arrive, which typically occurs within one business day

The most important thing to remember is that each lender has its own terms and conditions.

So, while two lenders may offer you the same amount of money, the terms and conditions – such as the interest rate and repayment period – may not be the same.

Repaying Your Loan

Zippyloan is not a lender, but instead a personal loan broker. For this reason, you’ll repay the money you borrow to the lender you decide on.

Most lenders offer a variety of repayment terms, ranging from 12 to 60 months. A shorter term typically comes with a lower interest rate, but a higher monthly payment. Conversely, longer terms have higher rates but a lower monthly payment.

Note: Zippyloan also works with a network of short-term lenders offering smaller loans designed to be paid back when you receive your next paycheck. This is not the same as a personal loan, so make sure you know what you’re applying for and the terms of the deal.

Final Thoughts

It can take a lot of time to compare multiple personal loan lenders and products, especially if you don’t know where to start.

Zippyloan can step in to save you time and reduce stress, as they’re able to connect you with a large network of lenders that match your borrowing criteria.

Zippyloan isn’t the only personal loan broker, but it’s fast and efficient system makes it one of the best.

Related Posts :