Some people are in the habit of reviewing their credit report at least once a year. Other people can’t remember the last time they did this.

While you’re not required to regularly review your credit report, it’s a good habit to get into. Here are five reasons why:

It’s free:

Above all else, you don’t have to pay any money to review your credit report. Once a year, you can request a free credit report online. For example, you may want to do so in January of every year.

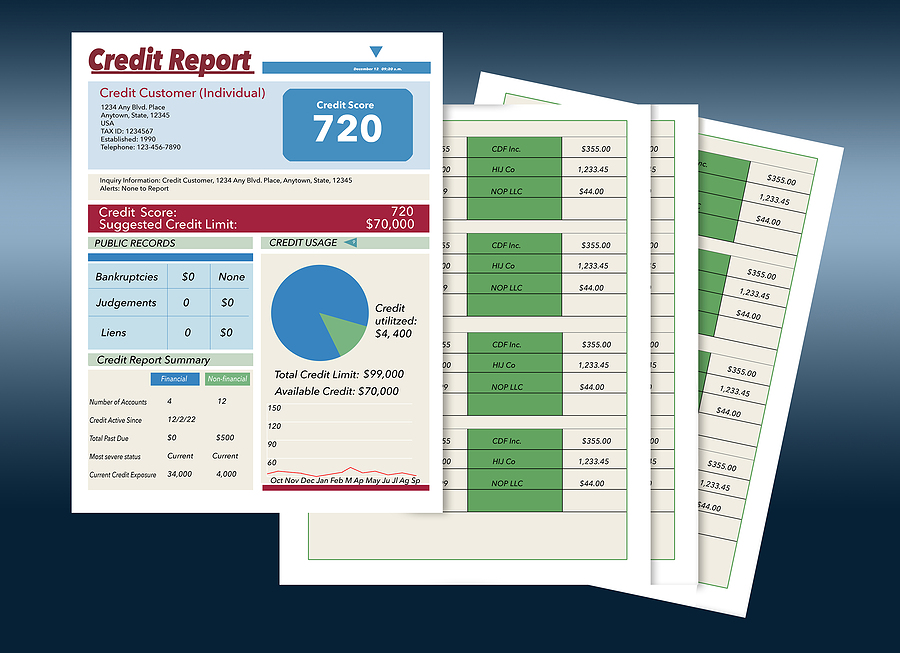

It’s a good high level overview of your financial health:

Your credit report can’t answer every question about your finances, but it can definitely provide you with valuable information that you otherwise wouldn’t have. For example, you can use it to better understand your debts and balances.

To check for errors:

It’s easy to assume that your credit report is error-free, but you may be surprised to find that this isn’t the case. For instance, you may find an account on your credit report that you didn’t open. Or maybe you find that an account was dinged with a late payment, despite the fact that this never happened. If you let errors linger, it could result in a lower credit score.

To protect against identity theft:

For example, if you find a name that you don’t know on your credit report, someone may have stolen your identify. The same holds true if there are accounts you never opened or Social Security numbers that don’t belong to you. The sooner you catch identity theft, the sooner you can take action to protect yourself in the future.

To make more informed financial decisions:

Maybe you’re in the process of searching for a credit card. Maybe you want to secure an auto loan or mortgage. Perhaps you’re interested in refinancing your home loan. When faced with important financial decisions, it’s critical that you’re informed of your circumstances. This allows you to make good choices.

Don’t obsess over your credit report, but get into the habit of reviewing it once or twice a year. As long as everything is accurate, it’ll only take a few minutes to acquaint yourself with the finer details.

If you can’t remember the last time you laid eyes on your credit report, it’s time to take action. All the numbers can be scary at first, but it won’t be long before you understand what they mean and how they can affect you and your finances in the future.

Credit score