Even if you have medical insurance, there’s no guarantee that you won’t receive a bill (or several bills) shortly after receiving treatment.

For example, the average cost of a hospital stay is more than $10,000, some of which may not be covered by your insurance policy.

Rather than collect your bills, make payments and hope to eliminate your debt as quickly as possible, you have another option: negotiate.

There’s no guarantee of success, but you never know until you ask. Here are a few tips you can follow to successfully negotiate medical bills:

1. Offer Cash on the Spot

This is one of the best strategies, as offering cash on the spot is enticing to any provider. Here’s why: they know that you’re in a bad financial spot, which means you may not pay any of the money if they don’t accept your offer.

Note: if you’re going to offer cash on the spot, be prepared to part with the money if the provider agrees.

2. Apply for a Hardship

Depending on your financial situation, you may not have the money to pay your medical bills. This can happen to anyone, so it’s nothing to be embarrassed about.

Contact your provider to ask about applying for a financial hardship. They can point you in the right direction, allowing you to receive a decision sooner rather than later.

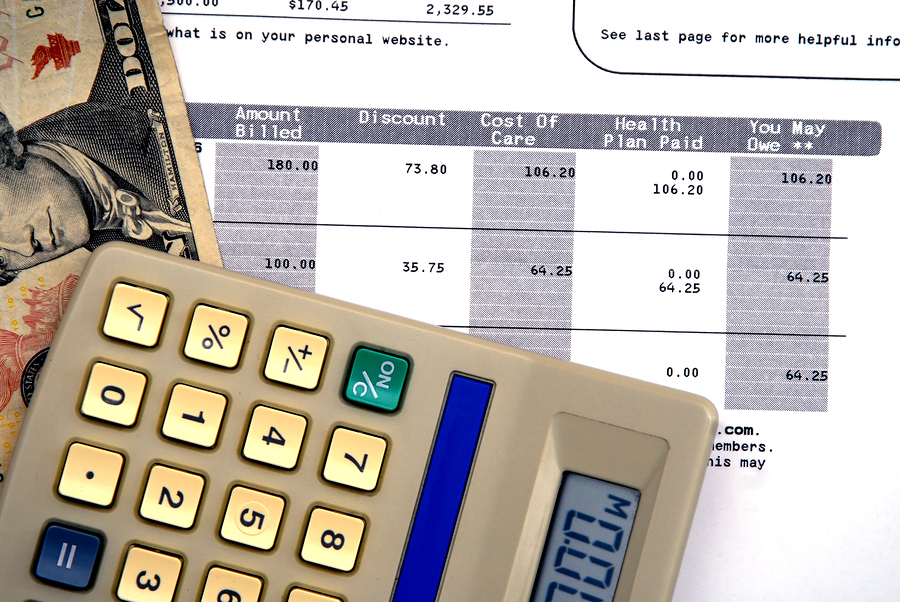

3. Check for Errors

This has nothing to do with offering cash or applying for a hardship. Instead, it’s all about reviewing your bill with an eye toward errors.

Yes, this can take some time. And yes, it can be a challenge to decipher medical bills, as many of them are complicated.

However, with enough patience, you can dig through the bill to see if there are any mistakes.

For example, you may find that you were billed for a treatment you didn’t receive. You may also come across duplicate billing, meaning you were charged twice for the same treatment.

4. Negotiate Payment Terms

It’s possible your medical provider will turn down all your requests for a discount. As frustrating as this may be, don’t give up just yet.

It’s now time to negotiate payment terms, such as a payment plan that allows you to payoff your debt over an extended period of time.

Let the billing department know how much you can afford each month and the date on which you can make payments. If they shoot you down, tell them that’s all you can afford. This is usually enough to reach an agreement, since the provider will have fears of you paying nothing.

Final Thoughts

Don’t immediately pay every medical bill that shows up in your mailbox. You may be able to negotiate a lower price or better terms, allowing you to avoid a financial hardship.

It takes time and effort to negotiate medical bills, but it’s almost always worth it in the end.

Related Posts :